Five leading investment management companies joined TMI to discuss some of the issues that corporate investors are facing today.

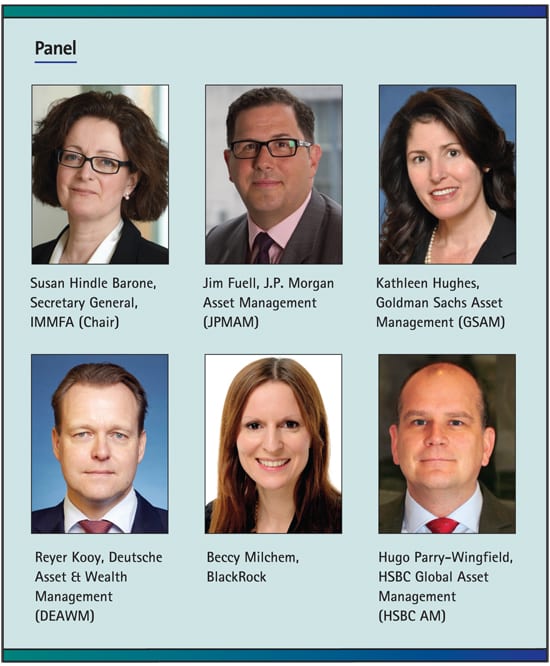

In September 2015, five leading investment management companies joined TMI to discuss some of the issues that corporate investors are facing today, and how they should prepare for changing times ahead with both banking and money market fund (MMF) reforms, and the ongoing challenges of a low or negative interest rate environment. The panel was kindly chaired by Susan Hindle Barone, Secretary General of the Institutional Money Market Funds Association (IMMFA), the trade association which represents the European constant net asset value (CNAV) money market fund industry.

Susan Hindle Barone, IMMFA

Given the developments that are taking place in the cash investment market, how would you characterise corporate investment priorities at the moment?

Kathleen Hughes, GSAM

In Europe, the challenge is to maintain a positive return on assets in a negative rate environment.

We’re seeing a number of broad themes, some of which are global, and some that are more specific to particular locations. In the UK, for example, treasurers are taking a strategic view, looking at separately managed accounts (SMAs), longer-dated deposits, and term repos in some cases, although with non-traditional collateral as it’s quite difficult for corporate triparty repo investors to access government collateral repo. Also, the documentation can be a deterrent for some treasurers.

In Europe, the challenge is to maintain a positive return on assets in a negative rate environment. We’re seeing clients reducing their euro cash balances in favour of other currencies wherever possible, and looking at opportunities such as SMAs to boost returns.

In the US, regulation is the primary focus, as Basel III and changing bank regulations are having an earlier impact, and money market fund (MMF) regulations have changed and will be implemented more quickly than in Europe. Treasurers are using SMAs more, and new products are coming to market.

Susan Hindle Barone, IMMFA

I think the point you make about the US is particularly interesting as the final implementation date for new regulations is only a year away, while changes have not yet been introduced in Europe. So there could be a separation between these markets for the time being.[[[PAGE]]]

Hugo Parry-Wingfield, HSBC AM

Absolutely, but finding a home for corporate cash is a problem in every region. Whilst the headlines tend to emphasise that bank and non-bank financial institutions will be impacted most by some of the new bank rules, corporates too are finding that opportunities to place surplus cash deposits that they took for granted have the potential to dry up. While the priorities used to be liquidity, security and yield – and of course these still apply – finding someone who wants the cash in the first place is the first issue to deal with.

Susan Hindle Barone, IMMFA

These are issues treasurers have not had to deal with in the past, nor have they needed to question whether they need same-day access to all of their cash or what risks they are prepared to take. Do you think that most treasurers have a good grasp of the risks involved in some of the alternative investments that they are considering now?

Hugo Parry-Wingfield, HSBC AM

As providers, we need to help corporate investors understand what the differences between investment products are.

I think that’s a very good point. As providers, we need to help corporate investors understand what the differences between investment products are, some of which could be less familiar than instruments they have used in the past. In particular, it’s important that treasurers understand their risks: increased liquidity risk if they are investing over a longer-term horizon, and further potential risks if they are simply trying to increase their yield.

Reyer Kooy, DEAWM

The desire to generate yield is pushing corporate treasurers into a new territory in which MMF providers can support them. We can provide education but also investment options such as separately managed accounts (SMAs) or different types of fund structure that provide access to new markets in a carefully controlled way, with proper fiduciary overlay of credit, due diligence and analysis.

Beccy Milchem, BlackRock

In this environment, we are seeing different reactions from corporate investors: those that are responding to changes as they occur, and those that are being proactive in revising policies to be more flexible. Given that the market is going through such a fundamental change, it’s really important to access specialist investment expertise to help meet objectives without exposing the organisation to excessive risk, particularly when pursuing yield in EUR.

Susan Hindle Barone, IMMFA

One of the decisions that some corporations are making is to go down the credit spectrum in their choice of counterparty banks, but the same has not yet happened for MMFs, so most treasurers are still limiting their choice to AAA-rated funds. At present, there is arguably not yet a smooth spectrum of products between an AAA-rated MMF and alternatives such as a bond fund. This seems unlikely to change soon as it’s likely to be hard to launch new products while the implementation of new regulations is under way.

Reyer Kooy, DEAWM

I think there are two separate issues here: one is money fund reform, and the other is corporates’ demand for higher yield. The constant net asset value (CNAV) AAA-rated MMF industry is extremely well defined and quite homogenous, but as soon as you move beyond these instruments, there’s quite a broad range of products that might still be highly-rated, but are far less homogenous. Treasurers therefore need to do more due diligence to understand their investment exposures, the credibility and track record of their provider, etc. While these are important steps in any investment process, the AAA-rating has given treasurers some comfort in the past; today, this due diligence is essential. This is challenging given that most corporate treasury departments have limited resources, so outsourcing to an expert fund manager is often a valuable means of achieving an appropriate level of due diligence and credit analysis without having to invest directly in these resources.

Susan Hindle Barone, IMMFA

In some ways, I suppose sterling investors are quite fortunate at the moment, would you say, as they are in positive interest rate territory, so they can delay any changes in their policy?

Beccy Milchem, BlackRock

It’s interesting: we’re seeing a number of UK-based corporates who invest only in sterling testing the water with variable NAV (VNAV)-style funds and short duration bond funds. These investors are already overcoming some of the potential hurdles that new MMF reforms may introduce.

Kathleen Hughes, GSAM

This alludes to Reyer’s point: global product consistency has been eliminated by the combination of rate disparities, banking regulations and MMF regulations so that the neat package of investment objectives: liquidity; security; yield no longer exists. Now there is a trade-off to be made, which is apparent in the products that are now emerging. A SMA, for example, may offer liquidity and a higher yield, but lacks stable pricing. This is a major change for corporate investors and as Beccy said, treasurers are taking a more reactive than proactive approach, which perhaps accounts for why we aren’t seeing the pace of change that we’re seeing in the investment management community reflected amongst investors.

Beccy Milchem, BlackRock

Treasurers based in Europe should have the advantage of being able to look at what’s happening in the US and what products are emerging, and learn from US treasurers’ experience.

Jim Fuell, JPMAM

One thing to keep in mind regarding the behaviour of US investors, however, is that they will be responding to new regulations alongside what is most likely to be a rising rate environment. This possibly creates a further level of complexity to their decision-making process. [[[PAGE]]]

Susan Hindle Barone, IMMFA

One thing that is clear, however, is the need for education and support for treasurers, particularly given that they have small teams and little capacity to add specialist investment resources. In addition to investment managers’ individual relationships with each of these treasury functions, is there anything that should be done at the industry level to support corporate investors?

Jim Fuell, JPMAM

I would encourage treasurers to talk to their cash management banks. Find out how your bank views your cash balances today with the introduction of Basel III versus how they viewed them previously. Operational balances will have the most value for banks, and companies will likely want to make use of their banks’ capacity for their operating cash balances. However, they may also see a decline in appetite by banks for some portion of their cash balances. This changing appetite means that prudent treasurers will also want to consult with their investment managers, particularly if they are looking to modify their investment policies to reflect evolving market conditions. Their investment managers can also help them understand the impact of changing regulations on the broader short-term investment market and the various alternative options which are available.

Hugo Parry-Wingfield, HSBC AM

One of the difficulties is that while some banks have a clear position post-Basel III, many of the banks haven’t yet decided on or articulated their strategy to clients, including what will be classified as operational deposits, and what products they will offer as alternatives. This is likely to change over the next 12 months but at the moment, it is a moving target for treasurers – and indeed the wider industry. Investment managers can give a perspective on where we see things going, and where value may lie.

Susan Hindle Barone, IMMFA

This links into the issue that the instruments are increasingly lacking homogeneity, so ‘one size’ no longer ‘fits all’.

Reyer Kooy, DEAWM

We’re seeing more SMAs in the US, partly as US companies often hold larger cash balances.

Absolutely. SMAs are a good example, as although there are benefits, particularly the ability to be precise in meeting investment objectives, you also lose the pooling effect that’s inherent within a money fund or any other types of pool vehicle, so it is important to ensure sufficient diversification. We’re seeing more SMAs in the US, partly as US companies often hold larger cash balances. We may see a similar trend in Europe as bank and MMF regulations take effect, but there are differences in the market.

Susan Hindle Barone, IMMFA

We’re seeing more discussion about tri-party repos too. What are your thoughts on this as a viable investment alternative?

Kathleen Hughes, GSAM

I mentioned this earlier in relation to UK investors, but I think it depends on the collateral that a company is willing to accept. For companies that wanted government or treasury collateral, it was an option for a while. As broker-dealer balance sheets began to shrink, that option went away for corporates as this collateral was no longer available. As a result, if treasurers are in a position to use non-traditional collateral, repos are probably still an option, but many companies’ investment guidelines won’t allow this.

Hugo Parry-Wingfield, HSBC AM

There are also issues around the time and effort required for implementation and execution, such as documentation.

Beccy Milchem, BlackRock

I think this takes us back to the issue of resources. Many of the products that appear more attractive are buy-and-hold style products, and the willingness to take duration in credit comes into play. Do corporates have enough resource to really analyse these products and the associated credit and liquidity risks if they are investing directly? For example, a bank repo may work for some companies if they can afford to lock up their cash for 90 days and if they’re willing to take different types of collateral, but it is not the same investment proposition as a MMF. In reality, only a few companies have resources in place today to help assess these sorts of decisions.

Jim Fuell, JPMAM

The need for cash flow forecasting and the associated ability to segment investment balances is going to be increasingly important.

While we don’t know what the full impact of Basel III and its implications in terms of banks’ appetite for liability balances, it seems clear that returns on overnight investments will be negatively impacted. With this in mind, the need for cash flow forecasting and the associated ability to segment investment balances is going to be increasingly important. These are issues which have been discussed for years, but which are now coming to the fore.

Susan Hindle Barone, IMMFA

Are you seeing any trends amongst corporates to reduce their overall cash balances, or are companies still cautious and therefore maintaining large amounts on their balance sheets?

Kathleen Hughes, GSAM

We haven’t yet seen any material drop in cash balances, although regulatory change and difficulties in investing cash will probably be one of the factors that boards take into account when considering their options, e.g., do they invest in M&A, return cash to shareholders etc. However, we haven’t seen anyone making a proactive decision to reduce cash simply because the options are becoming trickier.[[[PAGE]]]

Reyer Kooy, DEAWM

What we have seen is not necessarily a fall in balances, but more flexibility in the range of currencies in which companies hold balances.

Kathleen Hughes, GSAM

This is also related to a more global approach to investment policy. As our clients are doing business around the world, they want to understand their investment options in other regions and currencies, and how they need to adapt their guidelines and policies to reflect regional differences.

Hugo Parry-Wingfield, HSBC AM

In many cases, clients’ businesses have now grown to a sufficient point in those local markets that, while they only needed to manage relatively modest local levels of daily liquidity in the past, they now have a critical mass that they need to manage to global standards, whilst taking into account local nuances. These investors might be looking for a consistent, high quality MMF solution in a new market to mirror their approach in their traditional home markets or hubs.

There is a very clear opportunity for local China AMs to provide MMFs to retail investors in China.

Reyer Kooy, DEAWM

China is a good example, There is a very clear, emerging opportunity for local China asset managers to provide money market funds to retail investors in China. We are seeing some bifurcation of the money fund industry in China where funds are either focused exclusively on retail investors, or corporate and institutional investors. At an institutional level, both local institutions but also multinational corporations are developing a very clear interest in using tools like MMFs. These funds are growing, with comparable benefits and drivers that we have seen in US and Europe in the past.

Susan Hindle Barone, IMMFA

Given the changing environment we’ve discussed: bank and MMF regulation; a low interest rate environment and globalisation, what are the most important messages you’d emphasise to corporate investors right now?

Kathleen Hughes, GSAM

I think Hugo’s point earlier was absolutely right: treasurers need to talk to their providers, understand the changes and how will they impact on their business. Second, build in as much flexibility to your investment policy and guidelines as possible to be able to operate efficiently in a changing, and largely unknown environment. This can take time, so start now if you have not already done so. Finally, review policies regularly to make sure they are fit for purpose in a changing environment.

Jim Fuell, JPMAM

Be proactive in your planning and focus on the fundamentals, such as segmenting cash and defining investment approaches for each segment to maximise the overall performance of your cash balances.

Kathleen Hughes, GSAM

It’s a great opportunity for treasurers to educate their investment committee or the board. Things are changing. There’s a lot happening. It’s a time when people are going to look to the treasurer for answers on what the business should be doing.

Jim Fuell, JPMAM

Many corporate investors have taken confidence from the structured, highly conservative AAA CNAV IMMFA MMFs, but this wrapper does not absolve treasurers of their responsibility to evaluate their fund manager, their investment approach, risk management policies, governance tools etc. This is important today, and will become even more important as companies look at stepping out into less structured, less homogenous products. Therefore, treasury departments that don’t already have the capacity or procedures in place to conduct this due diligence need to address this.

Kathleen Hughes, GSAM

I think it’s also important to note that treasurers are not alone. Individual fund managers, and the wider industry, particularly IMMFA, has a strong role to play in providing education and support to treasurers.

Susan Hindle Barone, IMMFA

Absolutely. Our aim is to make it as easy as possible for investors to understand the changing market and regulatory conditions, and provide information on what their options are.

With thanks to J.P. Morgan Asset Management for kindly hosting this event and to Susan Hindle Barone for chairing the panel. Susan has now left the IMMFA. TMI would like to acknowledge the huge contribution she has made to the Association and to the wider industry during her period as Secretary General.

You can find more information on IMMFA at www.immfa.org.